In the 21st century economy, a companies reputation is one of their most important assets. Wheras fifty years ago, scandals and cock ups were only really noted when they ended up in court or on the paghes of the Financial Times, in todays economy, visible cock ups are accessable at all our fingertips by simply doing a google search. A simple google search for "One Barnet BT" and "One Barnet Capita" will reveal page after page of blog entries, none of which are particularly complimentary. Any council wishing to consider going down the outsourcing route, will see the potential for alienation from the voters, if they follow the One Barnet model.

What does this mean for the shareholders of BT and Capita? It means less profits. Of course the One Barnet project will give them healthy profits, but what will it do for the chances of the companies developing more local authority business? Well I am not sure if the shareholders of BT and Capita Symonds are aware, but there are more journalists, TV producers and TV presenters living in the London Borough of Barnet than anywhere else in the UK. That is why stories such as the Metpro scandal have made the pages of National Newspapers. That is why the One Show interviewed me with regards to the closure of Friern Barnet. That is why the Guardian get myself and Mrs Angry to write articles. That is why ITV Tonight have used footage from films I've made in their documentary. That is why BBC London radio interviewed me when we released the film "A Tale of Two Barnets".

There have been major problems with outsourcing contracts around the UK, such as Sefton Council, and South West One. The difference with these and Barnet is that these aren't media hotspots in the way that London is. Recently we had Jonathan Ross opening a new library in Hampstead Garden Suburb. Esteemed film director, Ken Loach gave the introduction to the film "A Tale of Two Barnets". We had a bevvy of celebrities attending the screening of A Tale of Two Barnets at The House of Commons, including Eastenders star Joe Egan, Footballer Gary Peake and Eastenders and Bill Star Russell Floyd. Russell Floyd made an impassioned speech about the need for accountability at the showing.

All of this media activity has taken place even before the contracts have been signed. The eyes of the world will be on the contracts and how they perform. APSE and Professor Dexter Whitfield have already identified many deficiencies in the process of letting the contracts and the likely savings.

It may well be that the board and the shareholders of Capita and BT think that One Barnet is worth the risk. They may be party to information that the council have hidden from everyone detailing how the project will be a rip roaring success. It may be they've seen a secret version of the business plan, which shows that they will confound the critics and there will be no problems and no adverse publicity.

The Barnet Eye hasn't seen any such evidence and Barnet Council has produced none. If the project goes wrong and the project attracts widepspread national media coverage, then BT, Capita Symonds and any other associated company are likely to get a pounding in local, regional and national press, radio and TV.

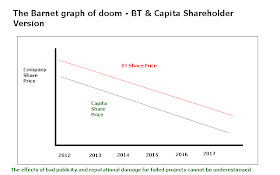

Companies which attract pariah status, generally suffer a massive drop off in share price, become undervalued and end up getting bought by rivals for peanuts. If I was a BT or a a Capita Symons Shareholder, I'd like to see some evidence that the company I part own has condisered how to mitgate this in relation to One Barnet. If they haven't I've helpfully produced a graph to show what could happen to the shareprice if it all goes wrong. It is based on the famous Barnet Graph of Doom.

As a matter of public record, I used to own shares in Capita. I have no plans to buy any in the near future.

Please note, this graph is not based on anything other than my gut feelings as to what will happen. Shares can go up as well as down and the Barnet Eye is not qualified to give financial advice. We merely publish this information for the army of small shareholders in Barnet and beyond, so that they can have a chat with the companies they part own, for reassurance as to the company strategy regarding their public sector contracts.

Excellent article Rog.

ReplyDeleteStrange how government ministers are having this daft argument over who knew what and when as regards the G4S scandal. And scandal it is. What joy to see the share price tumble!

This private company had ample time to deliver what was required and the money to do it, yet have made an embarrassing and potentially dangerous mess through not being entirely honest about the situation.

I hope the Barnet Cabinet of Doom are watching and learning something from the current debacle….