The Chief financial officer of Barnet Council has released their report, very late. The deadline for questions to the committee reviewing it was 10am yesterday morning. We've secured an extension, so questions can be taken. There are several highly concerning issues.

Here are my main concerns.

Corporate debt.

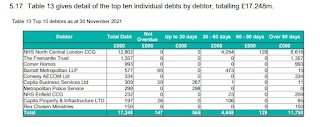

It seems that Barnet Council has lost control of it's debtors. It has over £17 million of corporate debt, eleven million of which is more than 90 days old. Interestingly, Capita, who feature prominently in the list are responsible for debt collection.

|

| Click on image for more readable image |

5.18 Regular discussions are taking place relating to NHS North Central London CCG debt. A payment of £4m expected to be made in Month 8 will now be made during Month 9. There has been recent agreement to pay on account for sums in respect of client recharges this will result in a further £4.5m of invoices outstanding being settled during Month 10. The account remains under close monitoring.

5.19 Legal discussions with The Fremantle Trust are ongoing.

5.20 The Comer Homes debt was cleared in Month 9.

5.21 Barratt Metropolitan LLP have paid £0.473m in Month 9. The remainder is under discussion with property services.

5.22 There are on-going final account negotiations with Conway to recover the outstanding debt, it is not known as yet when this is likely to be concluded.

5.23 Capita Business Services Ltd have paid the older than 30 days debts in Month 9 and the Accounts Receivable team are in discussion around the other balances.

5.24 Discussions are ongoing with the Metropolitan Police to reconcile the council invoices to their AP system and purchase orders.

5.25 Discussions are ongoing regarding the NHS Enfield CCG debt alongside the other CCG debts.

5.26 Capita Property & Infrastructure Ltd have paid £0.105m in Month 9 and they are investigating why the remaining balance has not been paid.

This really should be the subject of an Audit committee investigation. It is simply not right that taxpayers should have to carry the can for corporate debt running out of control. All I can really say is that the council needs a big overhaul of its debt management processes.

A few other notes

Brent Cross – The current 2021/22 position for the overall scheme is £4.849m over budget prior to the re-alignment virement agreed at P&R on 9 December 2021, which has aligned the forecast to the M7 detailed position. The overall programme has acknowledged potential inflationary pressures due to the impact of Covid-19. At present a detailed risk register is maintained within the service which includes pressures and efficiencies. As and when these potentially crystalise these will be included in the forecast as appropriate.

I am not at all sure why Barnet Council should be losing money on a commercial development risk. These things should be earners for the council. Once again Barnet Council shows it cannot manage large projects.

Depot Relocation – slippage of £2.082m into 22/23 relating to land purchase costs materialising in 22/23, adjustments to works programmes, and rescheduling of works at the Brogan’s site

This has been a fiasco from start to finish, another £2 million down the drain.

Environment – At Month 8 Environment is forecast to spend to £22.765m against budget, with £4.649m slippage.

Another four and a half million 'slippage' here. More proof that Barnet Council is not managing its budget.

Collection Fund – Council Tax

5.0 Overall collection continues to slightly improve compared to last year at 70.66%, which is 0.05% more than November 2020, but 1.11% lower than the previous year (i.e.prepandemic). In cash terms, current collection levels are £13.99m higher than last year and £15.4m higher than November 2019 (pre - pandemic) – this is due in part to annual increases in both the council tax base and the household charge over two budget cycles.

It seems that over 30% of people in Barnet have not paid their council tax. This is appalling. More than three in ten households in Barnet are not paying council tax.

The summary contains a truly bizarre statement

The financial position for the current year continues to be marked by uncertainty, however as we get closer to the end of the financial year, the uncertainty levels are reducing and increasingly the risks and opportunities on the budget are either falling away or converting to actual costs and overspends, from a combination of the impact of Covid-19 and other pressures including inflationary increases and supply chain and distribution challenges.

Suggesting that risks are falling away because they are turing into 'actual costs and overspends' is perhaps the strangest statement I've ever seen on a Council report.

To summarise. Barnet can't manage projects properly, can't manage corporate debt and can't collect council tax properly. In short, the Barnet Tories have destroyed the ability to function as a council over the period since Mike Freer MP was leader and launched the One Barnet Outsourcing programme. You may not believe me, but the evidence is there in black and white from the chief financial officer.

I have submitted the following question to the committee on this subject

"Given that the CFO's report details that corporate debt is being mismanaged, council tax collection is less than 70% and that several major infrastructure projects have millions of pounds of cash overruns, what level of confidence can we have in this adminstration to manage taxpayers finances?".

No comments:

Post a Comment